Evgen verzun

Blog

June 28, 2023

Crypto Attitudes: Where Do You Fall On The -Mism Scale?

Recently I was featured in the article grimly called ‘Is crypto finally dead?’ at TechMonitor, and to say the least, experts have expressed opinions that differ drastically from each other. Don’t worry, I was in the camp of crypto supporters, and coincidentally, in the minority.

Usually, the divide on crypto’s enthusiasm scale relies on two general terms - bullish and bearish. Upon reviewing the full article, I realized that between black and white there are a hundred of various gray undertones, and between extremely pessimistic and overly optimistic views we have quite a lot of other, more sensible thoughts and views.

There are levels to this game, and today I intend to figure out a scale that would help us determine our mental positioning when it comes to the future of crypto.

Between Bulls and Bears We Have An Entire Zoo

Before we proceed, let’s talk about disposition related to the market sentiment, and define who exactly those ‘bulls’ and ‘bears’ are.

Since I’m a fairly optimistic person, we will start with those market representatives who keep the industry going, contribute to its growth and development, create a new financial paradigm, or simply ‘trust the process’ and believe in the benefits of decentralization.

Ladies and gentlemen, I present to you, the bulls! These majestic creatures agree that:

- Blockchain technology is a novel and powerful innovation that solves long-standing computer science problems

- Distributed ledger technology promotes privacy, openness, market efficiency, and merit

- Cryptocurrencies are just getting started, and will reach much higher value

- Blockchain tech will transform the economy, and benefit every part of society

- Cryptocurrencies move trust from human organizations and governments to code-based solutions

We could write books about opinions and beliefs that would constitute the thinking of a traditional ‘bull’, but five points would suffice for now.

On the other side of the spectrum we have another menacing animal that puts the integrity of the industry under question, displays disbelief in its value and prospects of growth, views the market as overinflated, and generally retorts to negative thoughts when the topic of crypto comes up.

Boys and girls, on the other side of The Ark we have the bears, who think that:

- Cryptocurrencies serve no real purpose

- The technology is new, unproven, and vulnerable to hacking and theft

- The explosive growth is motivated exclusively by greed

- Cryptocurrencies lack oversight by financial regulators, and should be avoided as investment vehicles

- Mining wastes resources and exacerbates global warming

You get the gist… I put the mining argument last because I’ve been busy cooking up a few articles about creative ways to mine crypto in my column at Blockleaders.

Apart from quirky and stimulating ways to get coins, there are plenty of green ways to do it as well. But this article is not about converting bears into bulls, it is about highlighting the cognitive dissonance between market participants. All of the aforementioned arguments are not the truth in the last instance, as truth is way more nuanced than an opinion presented in black or white colors.

Let’s try to determine the shades of gray that could represent a weighted approach when it comes to pre-conceptions and general opinions.

Spoilt For Choice: From Charcoal to Platinum

Although defining levels of bearish and bullish positioning would be funnier by assigning new animals on the taskforce, let actually stick to the shades of gray.

You’ll understand why I would opt for that in a few sentences, as I am going to pull quotes from the article I was featured in, and it would feel wrong to label someone’s opinion with an animal of questionable reputation… I’ll go in the order those quotes were provided.

“I think crypto is largely screwed. Regulators hate it. Banks hate it. People who have interest in economic stability hate it.” - David Gerard

For me, this opinion puts Mr. Gerard’s stance in the dark charcoal territory. However, just a few lines later we have a drastically different approach to counter the negativity.

“I do not subscribe to the view that the crypto industry is dead – we’ve heard that many, many times over the last decade. All markets are pretty much having difficulties these days. But the reality is that the culture of innovation and collaboration continues.” - Sandra Ro

That’s more like it! I can feel platinum accents in that opinion, and personally, I share Sandra’s sentiment. Although she agrees that this a recurring theme, she believes in crypto long-term.

As do I! Here’s a proof, a ‘white smoke’ colored opinion, from my perspective.

“There are no eternal trends on the crypto market. The industry is cyclical, much like Wall Street, so sooner or later the crypto winter will be replaced by a growth phase.”

Everyone Has The Right To Hold Their Own Opinion…

…But we need more nuanced opinions that take into account both perspectives.

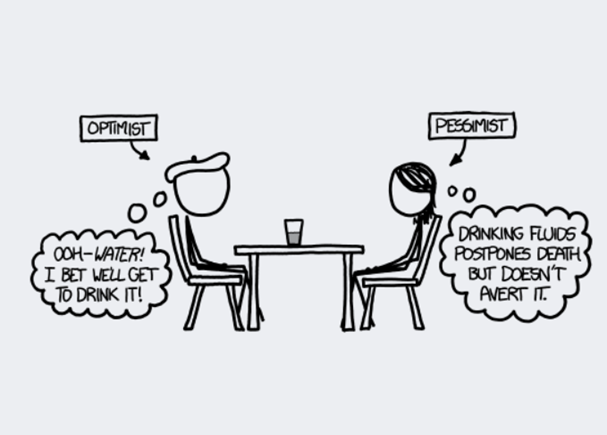

No matter where you find yourself on the crypto color scheme, you might agree that truth lies somewhere in between and it is important to come to new perspectives that transcend instinctive optimism or naive pessimism.

Crypto is often compared to the tulip craze during the Dutch Golden Age, but Ben Thompson argues that it has more in common with the dot-com bubble of the 90’s, where good businesses were 15 years too early. Even if there’s a bubble, it is a bubble of timing, not of irrationality.

I found a handy crypto compass that describes 4 stances.

Source: Why Market Optimism Matters for Successful Investing, brownandco.com

As much as I agree with the graph above, I think we can expand and transform it to levels:

Level 1: Dark Charcoal or Extreme Pessimism. Excessively negative outlook on crypto, doom and gloom scenarios, no room for hope or positivity. ‘Burn it down’ approach sometimes comes with a motivation to harm crypto for own benefit.

Level 2: Stormcloud or Strong Pessimism. Crypto pessimism is still dominant, but not as extreme. Finding optimism or silver linings is challenging for these individuals.

Level 3: Templeton Gray or Mild Pessimism. Individuals lean towards crypto pessimism but with occasional glimpses of optimism. Negativity still prevails, but there may be fleeting moments of hope. We’re all going to make it… right!?

Level 4: Agreeable Gray or Balanced Realism. People that attempt to strike a balance between pessimism and optimism and that view situations with a more objective and realistic perspective. Everyone likes to thinks they fall somewhere here. That’s unlikely.

Level 5: White Smoke or Moderate Optimism. Individuals tend to have a positive outlook on crypto, expecting favorable outcomes in many situations. They are open to possibilities and are willing to take risks, while still acknowledging potential obstacles.

Level 6: Platinum or Strong Optimism. Individuals have a generally positive mindset, actively seeking opportunities for growth and success. They maintain a hopeful attitude and believe in their ability to overcome obstacles.

Level 7: Whitest White or Extreme Optimism. An overly optimistic view on crypto, where individuals expect the best outcomes and often overlooking potential risks or challenges. ‘100K BTC tomorrow, we are going to The Moon’ gang belongs here, if not retorting to sarcasm.

Seven levels seems like enough. What makes it complicated is the human psyche.

Sometimes the biggest crypto supporters will be critical of its aspects not to appear bias. I see this often in sports, where pundits on television who played for some team would be overly harsh on its players, given that their expectations are higher.

And even though there are so many gradations of crypto-misms (new word?), the most useful perspective to hold is that everything is getting better and worse simultaneously, in different respects, all the time. This perspective allows people to take advantage of positive developments and prepare for negative outcomes.

Remember, the glass is not half full or half empty, it is refillable.

What’s your opinion on crypto in 2023? Which color describes your positioning the best, and how would you improve the scale to be more precise?

Share your thoughts with me, follow this blog, and keep refilling that glass!