Evgen verzun

Blog

November 9, 2022

Revisiting The Ethereum Improvement Proposal 1559

To improve is to change, to be perfect is to change often. This is how the saying goes, at least.

Sometimes things don’t go according to the plan, some changes divide the community into different camps, and a lot of people will stick to old, proven ways. This was the case with the Ethereum Improvement Proposal 1559, later just EIP 1559 - a proposal to reform the Ethereum fee market for the better.

I have addressed EIP and its potential consequences on Ethereum for FinanceMagnates a few years ago, so it’s fun to look back on and see where we find ourselves now. I guess it wouldn’t hurt to talk about it a bit more right here, with the benefit of hindsight. Subscribe and strap in!

Why Was EIP 1559 Needed?

First, we need to go back in time and define what this proposal aimed to fix.

On August 5, 2021, EIP 1559 was implemented as part of the London Hardfork. The upgrade changed how Ethereum processed and calculated gas fees, and changed the transaction inclusion system to battle inefficient and costly bidding on gas prices.But let’s roll back to the basics, so those of my readers who are not as familiar with the working process of Ethereum could understand the magnitude of proposed changes.

Public blockchain networks accept transactions from anyone on the network and add them to the blockchain. Transaction processing requires bandwidth, computation, and memory resources, plus there’s a limit to the number of transactions that can be processed at a time.

Ethereum processes about 30 transactions per second, so for efficient allocation of the resources, blockchains charge a transaction fee.

- User bids a transaction fee (gas) associated with the transaction.

- The miner chooses which transactions to include in the block.

- The miner gets all the transaction fees that users bid in the block.

First-price auction required users to either overpay transaction fees or have a longer waiting time, which is not ideal to say the least.

In periods of high demand, transaction fees are extremely volatile, making it difficult to make the right bid. For example, some individual paid a $2,600,000 fee to send $130 worth of ETH. That’s roughly 2,000,000% more than the transaction itself!

This is what EIP wanted to solve. But how would they do that?

Changes Brought By EIP 1559

Overall, EIP brought four major changes to the table. First of all, changed the requirement from fixed-sized blocks to variable-sized blocks.

Secondly, the upgrade introduced the system of ‘base fees’. The ‘base fee’ automatically adjusts to the network’s congestion level of transactions, providing a fair ‘market rate’ instead of referencing the historical fees.

In addition to the ‘base fee’, users could optionally bid two additional parameters in their transactions - max priority fee per gas, and max fee per gas. Priority fees are the tips that incentivized miners to prioritize their transactions. ‘Max fee’ is a mechanism that allows Ethereum users to set a maximum price they agree to pay as a transaction fee, limiting expenses. Thus, the clearer gas price could be obtained based on these three requirements.

Last but not least, EIP decided that the base fees would get burned, while the priority fee would be awarded to the miners. Before EIP 1559, miners got all the gas fees in a block, but with EIP-1559 implemented, tips became mandatory since miners did not earn the base fee anymore and otherwise would mine empty blocks. Miners lost out on a lot of money, while regular users were hopeful that this would make ETH more valuable…

As I said in that FinanceMagnates piece, “Even if EIP 1559 would be accepted, and assuming ETH 1.x runs adjacent to ETH 2.0 for several years, I believe that the amount of ETH burned as a result of EIP 1559 may be insignificant in light of the forthcoming ETH 2.0 release, since the new Ethereum algorithm will be based on a Proof-of-Stake consensus algorithm and a completely new mining principle.’

It’s really funny how that panned out. ‘The Merge’ really happened too, and not so long ago. Now though, let’s see if EIP was a good idea.

EIP 1559… Was It Any Good?

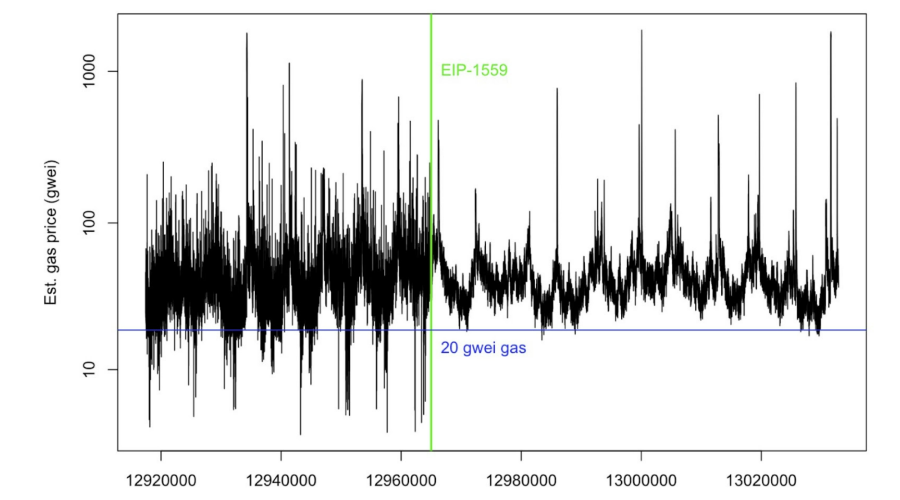

At a glance, EIP 1559 improved the user experience by making fee estimation easier.

However, it had a minimal effect on gas fee levels and blockchain security. EIP-1559 also did not make gas cheaper. It did not lower the transaction fee level, so now we can say that high gas fees are a scalability issue, not a mechanism design issue.

From the good things, we can highlight that it mitigated the intra-block difference of gas price paid, plus reduced waiting times for the users from ~17 secs to ~10 secs, possibly as a result of easier gas price bidding and variable-sized blocks. We can also claim that users who adopted EIP-1559 paid a lower fee than those who dismissed the new model.

However, there are a few worries about changes impacting consensus security, but extensive studies suggest that the impact is fairly modest.

From my point of view, the introduction was beneficial not only for the reasons described above, but also helped the community to find the shortcomings and suggest new ways to improve the transaction fee mechanism. We live, we learn, and we change… for the better!

If you found this article educational, please feel free to subscribe to my blog. No gas fees required to click that button!